In 2023, the UK bicycle market hit some tough terrain, with overall bike sales taking a dip. The Bicycle Association’s mid-year report shows an 8% drop in market value compared to the first half of 2022, signalling a challenging year for the cycling industry.

Our Open Project, now in its fifth year, dives deep into the 2023 cycling claims data from Bikmo.

This year, we’ve seen a 6% increase in our claims, reflecting our ongoing commitment to supporting more riders around the world. By breaking down barriers and providing clear, comprehensive coverage, we’re making it easier for you to explore new routes and ride with confidence.

Check out our claims breakdown below, and if you’re still considering how our cycle insurance can support your adventures, take a look at the benefits we offer.

Home and Away Claims

We’re noticing a rise in bike incidents happening away from home. In 2022, away-from-home claims made up 77% of the total, and now they account for 80%.

This highlights the growing need for cycle insurance that has you covered, whether your bike is in the garage at home or secured to a bike rail outside of work.

Ensure your bike is protected with comprehensive cycle insurance, no matter where you are.

Types of Claims

We’re seeing a rise in claims related to bicycle theft and accidental damage year after year. In 2023, we had to decline 2% more theft claims because the locking requirements weren’t met. This often happens when a basic lock, like a £5 Amazon lock, is used, or when the bike is only locked through a quick-release wheel rather than the frame.

To keep your bike protected wherever you go, make sure you’re using a Sold Secure Gold rated lock and secure your bike to an immoveable object through the frame.

We’re ramping up our efforts to keep riders informed about our locking requirements.

Payouts

In 2023, we saw an increase in payouts for higher-value bikes, with a 2% rise for bikes and gear over £5,000. But don’t worry if you’re riding something more modest – our most common payout is for bikes and gear valued under £500.

Whether you’re a dedicated pro or a daily commuter, we’ve got you covered, whatever you ride.

Did you know? You can insure a bike worth £500 for just £3.73/mo with Bikmo. That’s cheaper than a Netflix subscription!

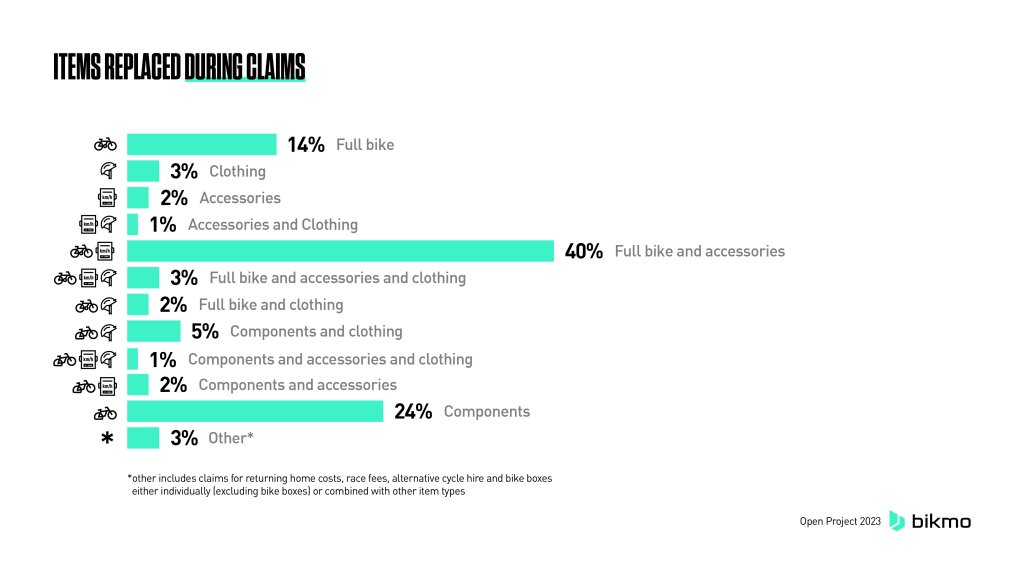

Items Replaced During Claims

So what are people actually claiming for? It’s not just about the bike. In fact, 40% of claims in 2023 were for the bike plus accessories (such as pedals, garmin devices or locks). It’s easy to overlook, but those components and accessories can really add up in value.

Claims Split Between Cycling Disciplines

Just like in past years, most of our claims are for road cycling and commuting bikes. This year, though, we’ve seen an 8% jump in e-bike claims, likely thanks to our 25% discount on e-bike policies.

It’s clear that more and more riders are choosing e-bikes and we’re here to keep them covered.

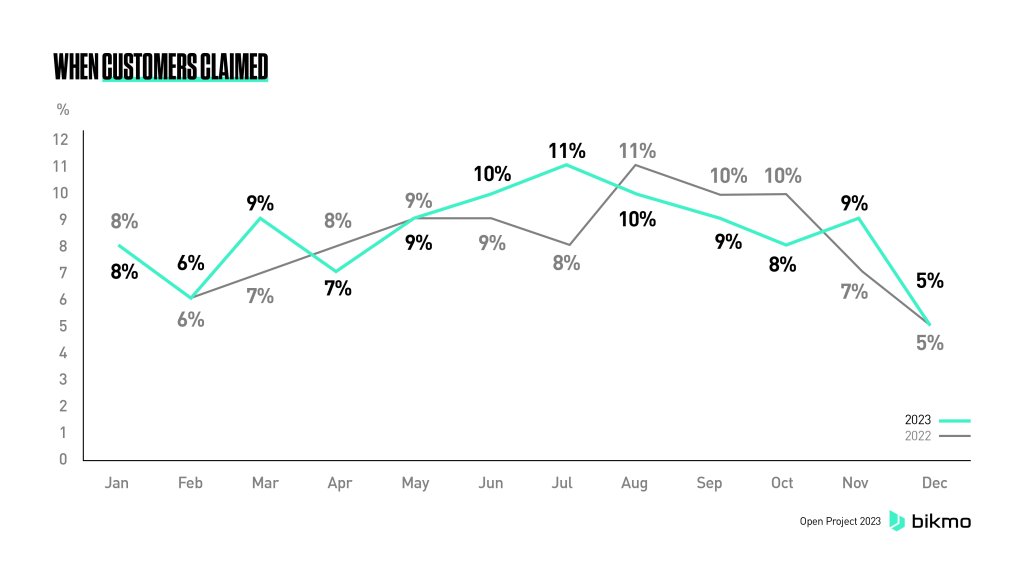

Month by Month Claims

We typically see the most claims in the summertime when more riders are out enjoying the sunny weather.

Cycling Claims in 2024: What to Expect

Our insights suggest that e-bikes will keep gaining popularity, leading to more claims from this category. With the shift towards active travel and sustainable commuting, we expect to see a rise in claims for incidents away from home.

The cycling world is always changing and so is our claim data. But one thing remains constant: Bikmo’s mission to protect the world’s riders and get you back riding as soon as possible.