Bikmo’s Home vs Cycle insurance guide

One of the most frequent questions asked is “What’s the difference between cycle specific insurance, to just adding a bike onto your home insurance policy?”

We can understand why this is asked. Often it seems like a cheaper option to just add a bike onto your existing home insurance but are you aware of how the cover differs between the two?

Check out our handy video below on what to look out for:

Below is a comparison table between our PROTECT cycle insurance policy vs two leading home insurer’s home insurance bike policies.

Compare our cover

Compare our cover

Bikmo

Aviva

Direct Line

What home insurance often doesn’t include compared to cycle insurance

Policy wording can often be a minefield to understand. We have made ours as simple as possible; not all insurers do.

It’s worth checking your home insurance policy, as it may not provide the cover you require.

- Maximum value – the maximum insured bike value can be as low as £500

- Away from home – there’s also often an ‘abandonment clause’ that classes bikes as ‘abandoned’ after only a few hours cycling away from home

- Premiums increasing – your premium will usually increase when making a claim

- Excess costs – home insurance excesses can mean it’s not worth claiming for your losses

- Personal accident cover – is usually not included

With a comprehensive cycle insurance policy from Bikmo, you can rest assured we have your back.

Plus, British Cycling members can access British Cycling Cycle Insurance by Bikmo, benefitting from:

- 10%* Discount

- 25%* Saving On E-Bike Premiums

- 50%* Discount on any additional bikes added to your policy from your household on your, including those of who you live with, with the discount applying to the lowest value bike(s)

Exclusions For Cycles

Another area that causes confusion is the cover and exclusions for ‘cycles’.

Read your home insurance policy wording carefully, as you may find that the definition of ‘cycle’ changes to ‘sports equipment while in use’ in the exclusions section.

It is important to check this, as it may mean you are not covered while actually riding your bike.

Maximum cycle value

With your home contents insurance, there will almost certainly be a limit on the value of cycles, which could be as low as £500.

If your bikes are worth more than this limit, they may need to be specifically declared on a home insurance policy, and they’ll want an additional premium. In many cases, home insurers will decline to provide cover for high value bikes.

Cover away from the home?

Some household policies will not provide cover for accidental damage or theft whilst the bike is away from the home, which is probably when you need it most!

Few also cover your bike when it’s outside of the UK – does yours?

We cover away from home as standard, providing it’s locked securely in line with our locking requirements

Check out our handy locking requirements video below and our full locking requirements here

Accidental Damage

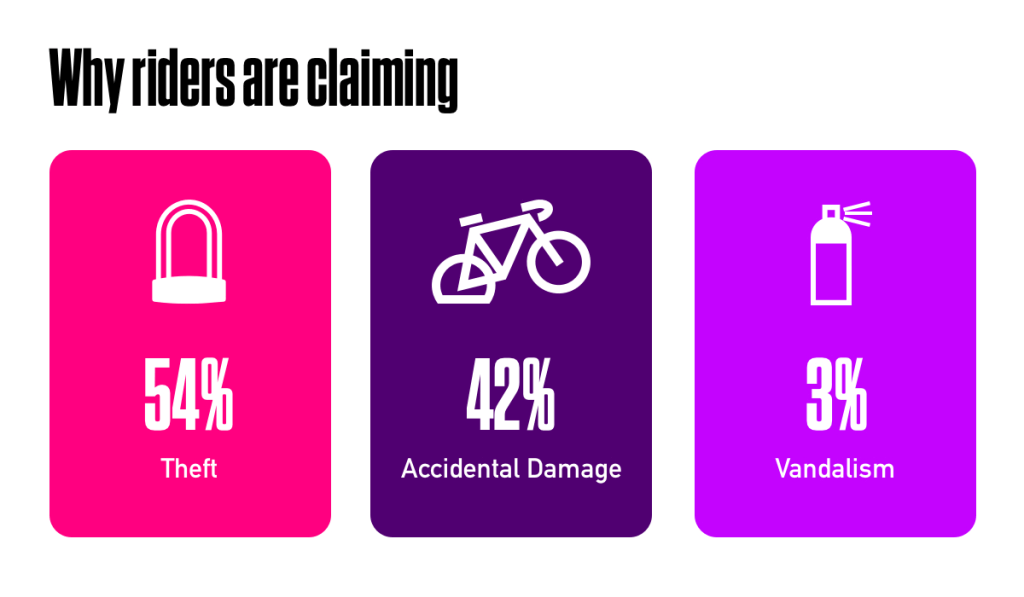

Many cyclists assume it is only theft that they’ll need to be protected against when it comes to cycle cover. However, at Bikmo, 42% of all claims from 2024 come from accidental damage while riding the bike, a factor many home insurers don’t cover against.

Clothing cover

With a jersey, shorts, warmers, helmet, glasses and shoes, cycling kit can often be close to your bike’s value! Clothing is usually the first thing to make contact with the tarmac in a crash. Check the policy wording to see if your other expensive kit is covered.

Competition cover

Whether you ride sportives or race DH, many of us like to race against the clock or competitors.

Your home contents policy may exclude damage caused when taking part in competitive or mass participation events, and they’ll almost certainly turn down a claim if your bike is stolen from a race transition area.

British Cycling Cycle Insurance by Bikmo is tailored for members to choose their level of cover for the type of events they ride, whether an enduro, triathlon, CX, road race or sportive. We have two policies to suit all kinds of riding for British Cycling members:

- Our PROTECT policy is for members looking for all-round cover, including most events and competitions.

- Our PROTECT-R policy is built for members who need cover with additional road, criterium & circuit racing cover.

Home insurance excess fees

When using your insurance, the last thing you want is to be stung with a sizeable excess when claiming. Home insurers often apply high excess fees that can be up to the value of £500.

With Bikmo, where available, you can opt to have £0 excess on bicycle claims when you replace through our retail partners.

Is your bike covered when you lend it to a friend or family member?

We often lend our bikes to friends, when they’re new to cycling or if a mate is in a fix before a race and needs a bike.

A home insurance policy will be in your name, so if you make a claim for damage or theft when you have lent the bike to a friend, the insurers may not pay out.

Bikmo covers your bikes as long as you’ve given your permission for a friend or family member to use them.

Home insurance premium increases

Your bikes may be one of the lowest-value items on the home insurance, but that doesn’t mean you won’t be stung with a hefty increase to your annual premium following a claim. Home insurers often increase your premium the following year if you have made a claim.

Making a claim with Bikmo won’t affect your house insurance policy.

Consider Dedicated Cycle Insurance

If you own bikes above £400, compete, travel or ride a lot, then you may want to consider cycle specific insurance.

At Bikmo, we’re all cyclists, and we designed our hassle-free policies to cover all cyclists, no matter how they ride, whether on roads, mountains or parks, in the UK or overseas.

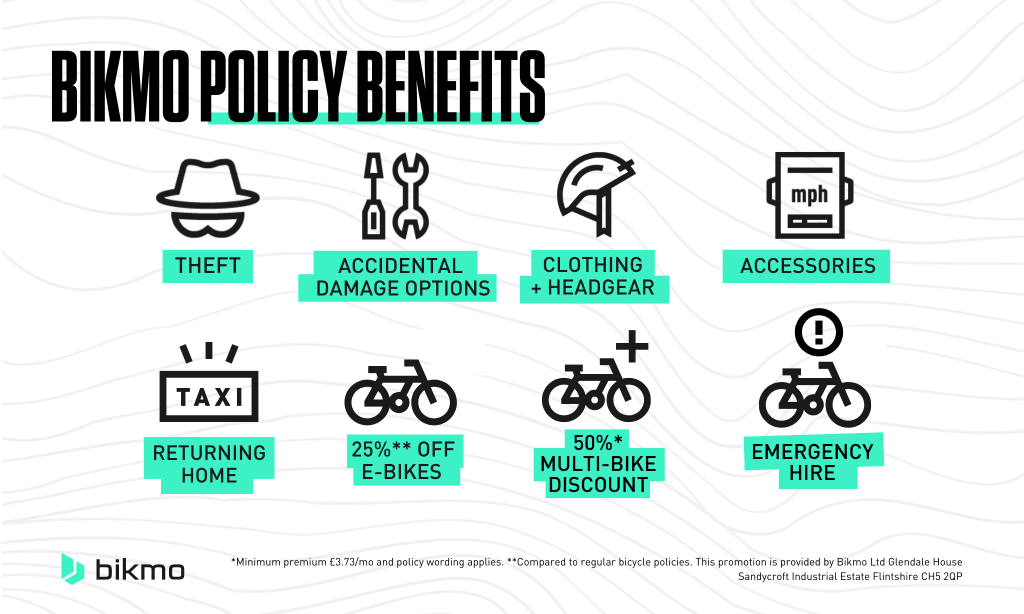

Bikmo policies can cover your bike(s), clothing and accessories against accidental damage, theft and much more. We also offer 365 worldwide cover, event cover, bike box cover and much more as standard.

Plus, British Cycling members can access British Cycling Cycle Insurance by Bikmo, benefitting from:

- 5%* Saving on full insurance policies

- 25%* on E-Bike Premiums

- 50%* Discount on any additional bikes added to your policy from your household on your, including those of who you live with, with the discount applying to the lowest value bike(s)

Why Bikmo?

🚴♀️ Tens of thousands of riders insure with Bikmo

⭐ Bikmo holds the prestigious Feefo Platinum Service Award for great service

🌎 Bikmo is a B Corp and 1% for the Planet certified, meaning we give 1% of our annual revenue back to good causes focussed on the environment.

Read more of our guides and blogs:

– Home Security – Securing Your Bike

– How To Value Your Bike For Insurance

Disclaimer – Coverage are true as per a web search on 10/10/2023. All coverage is subject to terms and conditions.

*Minimum premium £3.73/mo and policy wording applies. Terms and conditions apply. This promotion is provided by Bikmo Limited who are authorised and regulated by the Financial Conduct Authority ref: 745230.